GovWallet

Overview

Key Benefits

Payouts

Frontend Agnostic: Fully integrable with various citizen-facing systems such as LifeSG, Healthy365 and Workpal via API without the need to be entrenched in a single frontend app.

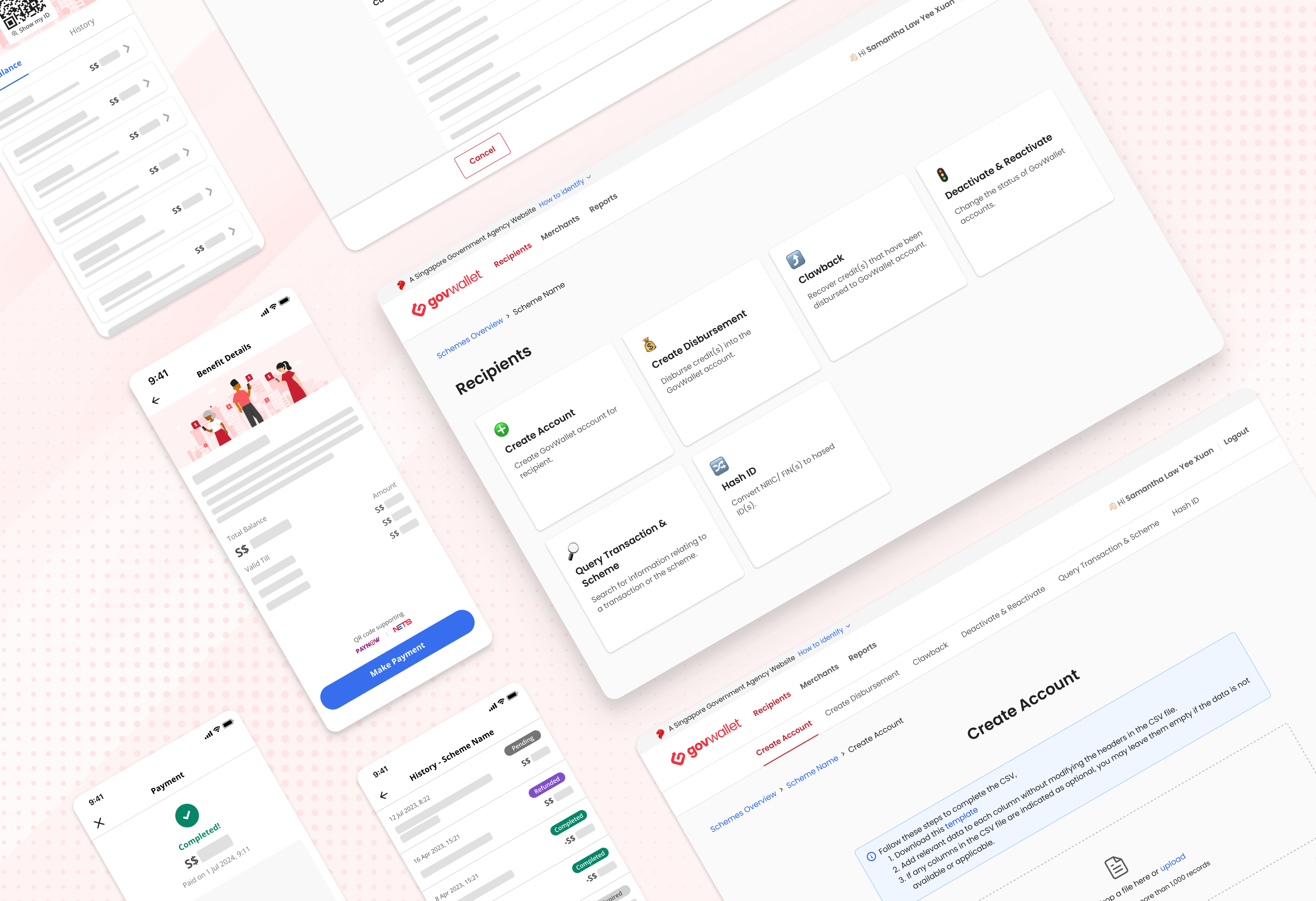

Self-Service Admin Portal: Manage and control your GovWallet schemes effortlessly through the admin portal, giving you full oversight of operations.

No merchant onboarding: Allow your credit users to spend their credits at any merchants who accept PayNow/NETS QRs (>200K merchants onboarded).

Control your credits: Better manage credit usage with credit expiry feature as well as merchant ringfencing.

Self-Service Admin Portal: Manage and control your GovWallet schemes effortlessly through the admin portal, giving you full oversight of operations.

No merchant onboarding: Allow your credit users to spend their credits at any merchants who accept PayNow/NETS QRs (>200K merchants onboarded).

Control your credits: Better manage credit usage with credit expiry feature as well as merchant ringfencing.

Collections

Single platform to orchestrate your collections: Agencies’ systems are required to integrate only with GovWallet. GovWallet will handle integration with the Payment Service Providers of your choice.

Co-payment capability: Unique to GovWallet, this capability can support co-payment from GovWallet payouts and user’s out-of-pocket funds in a single transaction.

Consolidated admin functions: Access your transaction reports and perform refunds across multiple payment service providers via our GovWallet Admin Portal.

Leverage existing Payment Service Providers: GovWallet can integrate with Payment Service Providers in the Government Bulk Tender GVT (T) 24010.

Co-payment capability: Unique to GovWallet, this capability can support co-payment from GovWallet payouts and user’s out-of-pocket funds in a single transaction.

Consolidated admin functions: Access your transaction reports and perform refunds across multiple payment service providers via our GovWallet Admin Portal.

Leverage existing Payment Service Providers: GovWallet can integrate with Payment Service Providers in the Government Bulk Tender GVT (T) 24010.

Statistics

9

Agencies Onboarded

> $1B

Payouts Supported

100%

Service Uptime

What They Say

Awards & Recognitions

Public Sector Transformation Awards 2025

One Public Service Award

Last updated 09 Jan 2026

Was this article useful?

Did this page help you? - Yes

Thanks for letting us know that this page is useful for you!

If you've got a moment, please tell us what we did right so that we can do more of it.

Did this page help you? - No

Thanks for letting us know that this page still needs work to be done.

If you've got a moment, please tell us how we can make this page better.

Sent. Thank you for the feedback!

The e-Wallet Module That Makes Payouts and Collections Effortless